October deadlines

Make sure you do not miss these October deadlines.

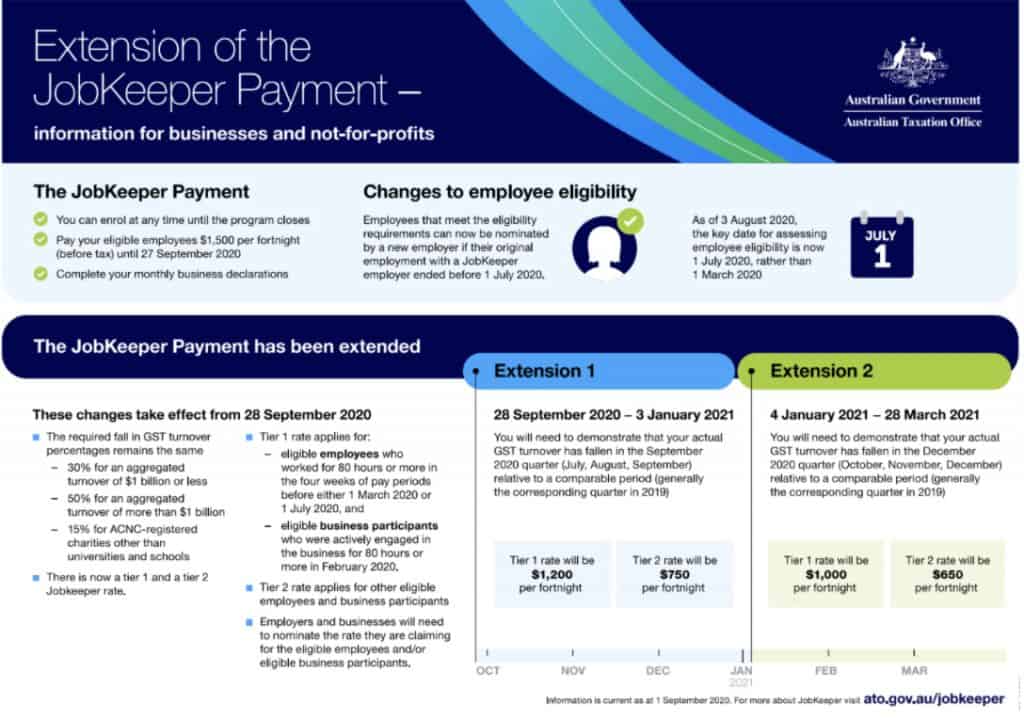

31ST OCTOBER – DEADLINE FOR JOBKEEPER EXTENSION

Complete the following requirements between now and 31st October for a smooth transition to the next round of JobKeeper support

Ensure your JobKeeper Extension eligibility by determining and submitting your decline in turnover for the September 2020 quarter to the ATO.

Determine the rate of JobKeeper applicable for each eligible employee

Pay your eligible employees for JobKeeper fortnights 14 and 15 (starting 28 September 2020 and 12 October 2020). You need to pay each eligible employee at least the JobKeeper payment rate that applies to them.

28TH OCTOBER – DEADLINE FOR SUPER

Your monthly or quarterly Superannuation guarantee (SG) is due for payment by 28th October.

If you don’t pay the minimum amount of super guarantee (SG) for your employee into the correct fund by the due date you may have to pay the super guarantee charge (SGC) to the ATO.

The charge includes the super payable, interest and an administration fee. Notably, it is not tax-deductible.